Table of Content

- What Are Carbon Credits?

- How Carbon Credit Trading Works

- Global Carbon Credit Trading Markets

- 1. European Union Emissions Trading System (EU ETS)

- 2. California Cap-and-Trade Program

- 3. Regional Greenhouse Gas Initiative (RGGI), USA

- 4. Voluntary Carbon Markets (VCMs)

- Carbon Credit Trading in India

- Benefits of Carbon Credit Trading

- Challenges of Carbon Credit Trading

- Future of Carbon Credit Trading

- How Individuals Can Participate

- Frequently Asked Questions (FAQs)

- Conclusion

In the era of climate change and global warming, reducing greenhouse gas (GHG) emissions has become one of the most critical priorities for governments, businesses, and individuals. Among the various mechanisms developed to tackle environmental degradation, carbon credit trading has emerged as a key strategy to incentivize emission reductions while promoting economic flexibility.

Carbon credit trading, also known as emissions trading, allows entities to buy and sell “carbon credits” – permits representing the right to emit a certain amount of greenhouse gases. This market-based approach combines environmental responsibility with economic efficiency, encouraging innovation and sustainability.

This article delves into the concept, functioning, global and national practices, benefits, challenges, and future prospects of carbon credit trading.

What Are Carbon Credits?

A carbon credit represents the permission to emit one metric ton of carbon dioxide (CO₂) or an equivalent amount of another greenhouse gas. It acts as a tradable certificate issued by governments or regulatory bodies under international agreements, such as the Kyoto Protocol and the Paris Agreement.

There are two main types of carbon credits:

-

Verified Emission Reductions (VERs) – These are generated through voluntary programs, such as afforestation or renewable energy projects.

-

Certified Emission Reductions (CERs) – Issued under regulatory compliance programs like the Clean Development Mechanism (CDM).

By allowing organizations that can reduce emissions at lower costs to sell excess credits to those facing higher reduction costs, carbon trading creates a financial incentive to reduce greenhouse gases.

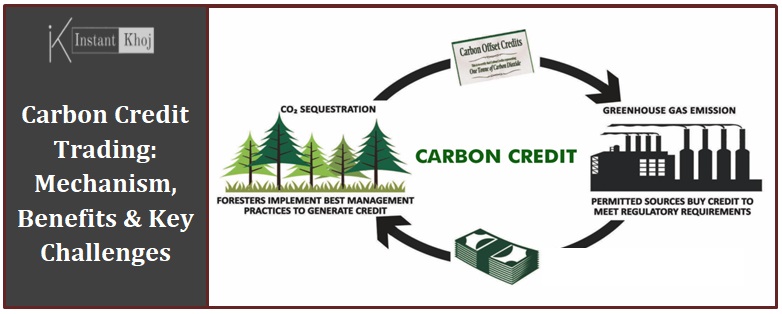

How Carbon Credit Trading Works

Carbon credit trading operates as a market-based mechanism, often referred to as a cap-and-trade system. Here’s a step-by-step overview:

-

Setting a Cap: Governments or regulatory authorities set a limit (cap) on the total emissions allowed for industries or sectors.

-

Issuing Credits: Companies receive carbon credits corresponding to their allowed emissions under the cap.

-

Monitoring and Reporting: Companies measure and report their actual emissions, which are verified by independent agencies.

-

Trading Credits: Companies that emit less than their quota can sell surplus credits to those exceeding their cap.

-

Compliance: At the end of a compliance period, companies must surrender sufficient credits to cover their emissions or face penalties.

For example, if a power plant has a cap of 100,000 tons of CO₂ and emits only 90,000 tons, it can sell the remaining 10,000 tons as carbon credits to another company exceeding its limit. This system ensures overall emission reductions while allowing economic flexibility.

Global Carbon Credit Trading Markets

Carbon trading has been adopted globally, with countries creating regulated and voluntary markets. Some of the key markets include:

1. European Union Emissions Trading System (EU ETS)

-

Launched in 2005, the EU ETS is the largest carbon market in the world.

-

It covers sectors like power generation, manufacturing, and aviation.

-

Companies buy or sell allowances, and the EU gradually reduces the cap to achieve emission targets.

2. California Cap-and-Trade Program

-

Introduced in 2012, it covers power plants, industrial facilities, and fuel distributors.

-

Revenues from carbon trading are used for clean energy initiatives.

3. Regional Greenhouse Gas Initiative (RGGI), USA

-

Covers power plants in northeastern US states.

-

It’s a market-based approach with quarterly auctions and a cap reduction schedule.

4. Voluntary Carbon Markets (VCMs)

-

Individuals and companies voluntarily buy carbon credits to offset their emissions.

-

Projects include reforestation, renewable energy, and methane capture.

-

These markets are growing rapidly due to increasing corporate ESG (Environmental, Social, Governance) commitments.

Carbon Credit Trading in India

India has embraced carbon credit mechanisms under the Clean Development Mechanism (CDM) of the Kyoto Protocol. Key points include:

-

India is among the top sellers of CERs in the global carbon market.

-

Renewable energy projects (solar, wind, biomass) generate carbon credits that can be traded internationally.

-

The Bureau of Energy Efficiency (BEE) and the Ministry of Environment, Forest and Climate Change (MoEFCC) oversee certification and trading.

India is also exploring a domestic carbon market, which could enhance financing for renewable projects while promoting sustainable industrial practices.

Benefits of Carbon Credit Trading

-

Economic Incentives for Emission Reduction

Companies can profit from reducing emissions below their quota by selling surplus credits. -

Cost-Effective Environmental Management

Companies facing high costs to reduce emissions can purchase credits instead of investing heavily in technology. -

Encourages Green Investments

Trading creates a financial incentive to invest in renewable energy, energy efficiency, and other carbon-reducing projects. -

Global Cooperation on Climate Goals

Carbon trading enables countries to collaborate and meet international climate commitments, reducing global greenhouse gas emissions. -

Promotes Corporate Responsibility

Businesses increasingly incorporate carbon management into their ESG strategies, improving brand reputation and sustainability credentials.

Challenges of Carbon Credit Trading

Despite its advantages, carbon trading faces several challenges:

-

Verification and Transparency

Ensuring that emission reductions are real, measurable, and permanent requires robust monitoring and auditing systems. -

Market Volatility

Carbon credit prices can fluctuate due to policy changes, economic cycles, and market speculation, making long-term planning difficult. -

Limited Scope in Some Countries

Developing countries often have limited participation due to lack of infrastructure, regulatory frameworks, or awareness. -

Risk of “Carbon Leakage”

Companies may shift emissions-intensive activities to countries with less stringent regulations, undermining environmental benefits. -

Ethical Concerns in Voluntary Markets

Some projects may overstate carbon reductions, leading to greenwashing and reputational risks.

Future of Carbon Credit Trading

The future of carbon trading looks promising, especially with increasing global commitments under the Paris Agreement to limit global warming to 1.5–2°C. Key trends include:

-

Integration of Advanced Technologies: Blockchain and AI can enhance transparency, traceability, and verification of credits.

-

Expansion of Voluntary Markets: Companies are increasingly pledging net-zero emissions, driving demand for voluntary carbon credits.

-

Linking National Markets: Countries are exploring cross-border trading to improve efficiency and cost-effectiveness.

-

Carbon Pricing Mechanisms: Governments may implement minimum price floors to stabilize markets and incentivize emission reductions.

How Individuals Can Participate

While carbon trading is often associated with industries and governments, individuals can also contribute:

-

Purchase Carbon Offsets: Many companies sell verified carbon credits for personal or household emission offsets.

-

Support Green Projects: Invest in tree plantations, renewable energy, or community-based environmental projects.

-

Reduce Personal Carbon Footprint: Use public transport, energy-efficient appliances, and sustainable practices, complementing carbon trading efforts.

Frequently Asked Questions (FAQs)

Q1: What is a carbon credit?

A1: A carbon credit represents the right to emit one metric ton of CO₂ or its equivalent. It is tradable in regulated and voluntary markets.

Q2: How does carbon trading reduce emissions?

A2: Carbon trading sets a cap on emissions and allows companies to buy or sell credits. Companies that reduce emissions can sell excess credits, incentivizing reductions.

Q3: What is the difference between CER and VER?

A3: CERs (Certified Emission Reductions) are regulated and issued under compliance programs, while VERs (Verified Emission Reductions) are voluntary.

Q4: Which countries have carbon trading systems?

A4: Major systems exist in the EU (EU ETS), California, RGGI in the USA, and emerging voluntary markets worldwide, including India.

Q5: Can individuals participate in carbon trading?

A5: Yes, individuals can buy voluntary carbon credits to offset personal emissions and support sustainable projects.

Q6: What are the main challenges of carbon trading?

A6: Challenges include market volatility, verification issues, carbon leakage, and limited participation in developing countries.

Q7: How does India participate in carbon trading?

A7: India generates carbon credits through renewable energy and energy efficiency projects under the Clean Development Mechanism (CDM), selling them internationally.

Q8: What is the future of carbon trading?

A8: The market is expected to grow due to net-zero commitments, technological integration (blockchain, AI), and cross-border trading initiatives.

Conclusion

Carbon credit trading has emerged as a powerful tool for mitigating climate change by linking economic incentives with environmental responsibility. It encourages industries and countries to reduce greenhouse gas emissions while providing cost-effective flexibility.

Though challenges exist, including verification, market volatility, and ethical concerns, technological advancements and global cooperation are likely to strengthen the system. For individuals, corporations, and governments, participating in carbon trading offers a meaningful way to contribute to a sustainable and low-carbon future.

As global climate commitments intensify, carbon credit trading will remain a critical component of international and domestic climate strategies, driving innovation, sustainability, and environmental stewardship worldwide.

Also Read:

RBI Keeps Repo Rate Unchanged at 5.5%: What It Means for You

YouTube Premium Lite India Launch — Affordable Ad-Free Plan

Follow Blog’son Instantkhoj for more latest stories and trending topics.